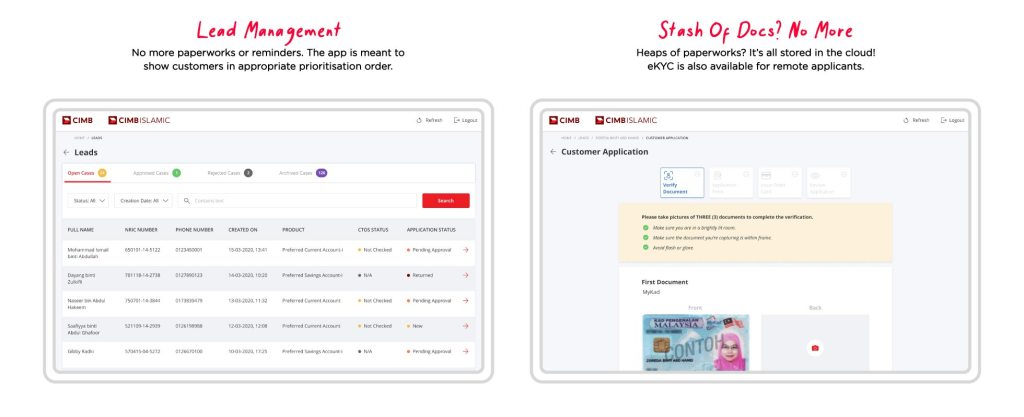

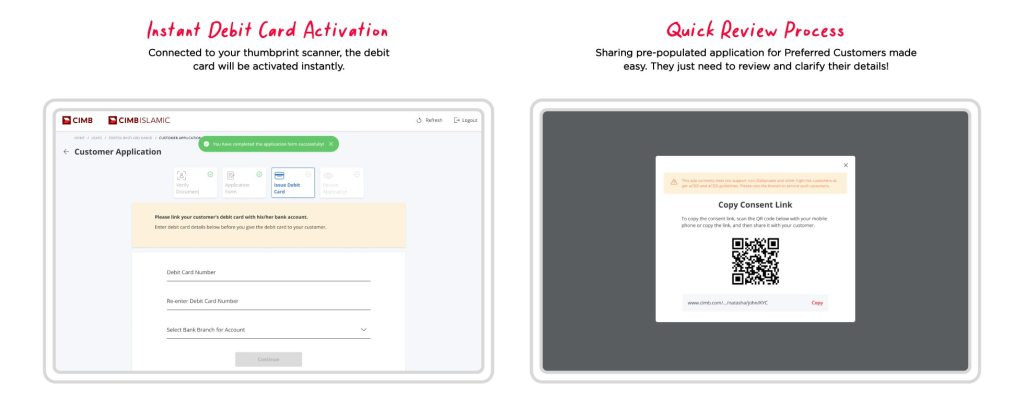

CIMB Onboard is a CRM hybrid app designed specifically for Relationship Managers’ (RMs) tablet devices. By digitizing the existing BAU (business-as-usual) processes, RMs experience minimal paperwork, accelerating workflows and reducing the carbon footprint associated with B2B lead management.

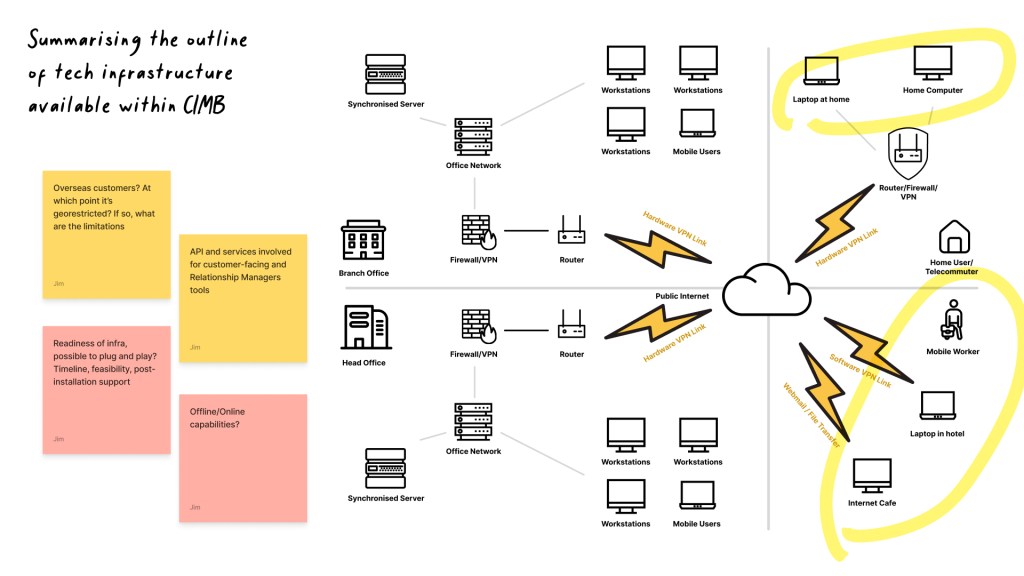

The primary challenge of this project was integrating the various software and services used in the onboarding process across different suppliers and departments into a single, streamlined platform. This involved unifying mass onboarding procedures, ensuring real-time updates of compliance documents during sign-ups, and synchronizing data processing for EMV cards in enterprise account openings, among other tasks.

Note: Content is still being developed as project is still ongoing, stay tuned!

Introduction

Saleem gets a job at a newly established construction company, he is told to open a bank account of the employer’s preference, he is given a letter to open it up at the nearest branch, there he sees 100 of his colleagues queueing up doing the same thing. Saleem had to take a day off and still his bank account won’t be open just yet. Saleem was told by the bank it will take at least 3 weeks for the card to be sent to his company.

We are trying to help people like Saleem and the company’s process of bulk account sign up. We’re talking about lessening; or better yet, diminishing processes such as logistically sending paper applications (2-3 days), face-to-face KYC, lengthy ECDD/ACDD check, manual identity card scanning and manual cash deposit. It’s not ideal, and the process isn’t that pleasant nor smooth for anyone involved.

Design Process

Incubation + Plan

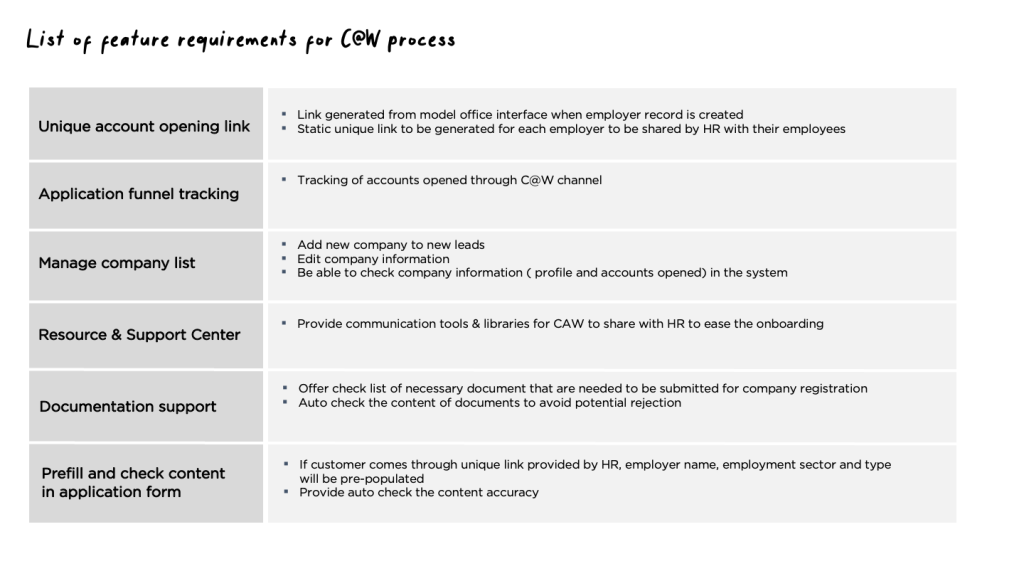

Onboarding app is a simple CRM platform we envisioned our CIMB@Work RMs or PAT (Preferred Acquisition Team) Members can use in the near future. C@W RMs can onboard the company and keep track of onboarding status of their employees easily. PAT Members can onboard preferred clients and keep track of their milestone.

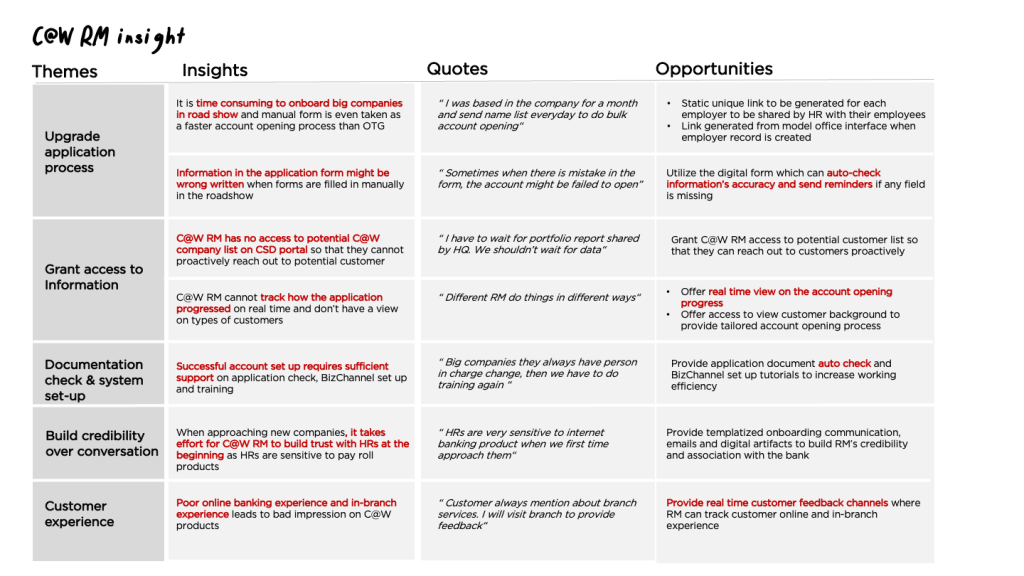

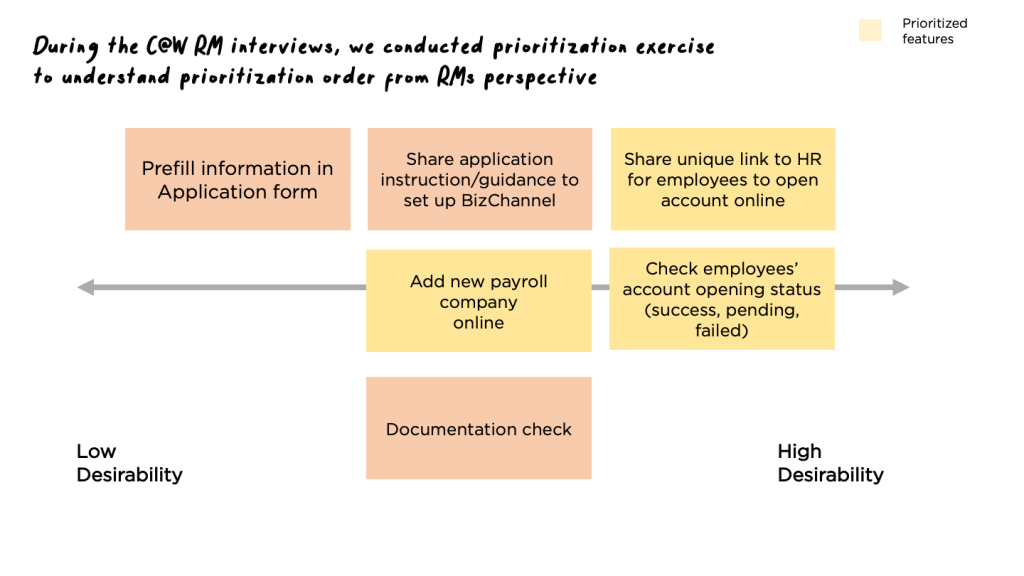

Along with the research team, we conducted in-depth interview with 4 C@W RM, 15 CSO and 6 PAT RM to understand pain points and defined opportunities for improving account opening process

Objective:

1) Understand current working progress, map out key events and understand pain points.

2) Understand collaboration model among different roles within branch and outside of branch.

3) Understand touch points (system, device) RMs are interacting with.

Outputs:

1) As-is Journey

2) Insights and opportunities

3) Persona

Design + Develop

The outcome of the interview highlighted the roles of three key Relationship Managers (RMs), each with distinct responsibilities:

PAT (Preferred Acquisition Team) RMs: Tasked with managing high-value customers who maintain significant balances, these RMs function much like personal financial advisors. They evaluate clients’ financial positions and offer tailored strategies to meet their long-term objectives. The approach taken by PAT RMs is highly flexible, adapting to the unique needs of each customer.

C@W (CIMB@WORK) RMs: These managers focus on facilitating mass account openings, primarily for newly established companies. Their involvement can vary from being physically present on-site to expedite the process, to taking 2-3 days for larger enterprises with over 100 employees. The extended timeline, especially for companies employing foreign workers, is often due to the thorough due diligence required.

CSOs (Customer Service Officers): Typically based in branches, CSOs handle day-to-day interactions with customers. They are the frontline staff, addressing a wide range of issues, especially those that arise post-account opening. CSOs play a crucial role in assisting account holders, ensuring a smooth and responsive service experience.

Below is the overview of the end-to-end user journey. This allows us to better identify opportunities where we can streamline the process, enabling a more unified platform:

As the development of the app progresses, the pivot of the app shifted from focusing mass onboarding to high value customers. The sample size for this specific target audience is also adequate for pilot phase before it further evolves to bulk account sign ups.

The project is still ongoing, stay tuned!